TSΕΚ Business Index (TSΕΚ Bi)

A reliable index for assessing the probability of a company's default on its obligations.

What is TSΕΚ Bi?

TSΕΚ Bi is a service provided by the TSΕΚ platform, offering you promptly, in an easily understandable report, an index to enable you quickly and reliably assess the probability of a company defaulting on its financial obligations within the next 12 months.

With this information you can more easily predict the short-term ability of your clients or partners to meet the credit terms you set and to grow your business by predicting potential risks.

The TSΕΚ Bi default probability index is calculated using a risk assessment model by Tiresias, which is produced in accordance with international recognized practices, and is systematically reviewed and updated, that assesses a company's creditworthiness based on its balance sheet data and financial statements. Tiresias' high expertise in developing credit behavior scoring systems, combined with its reliable financial and business data, make the TSΕΚ Bi report one of the most credible tools for assessing a company's default probability.

Information provided includes:

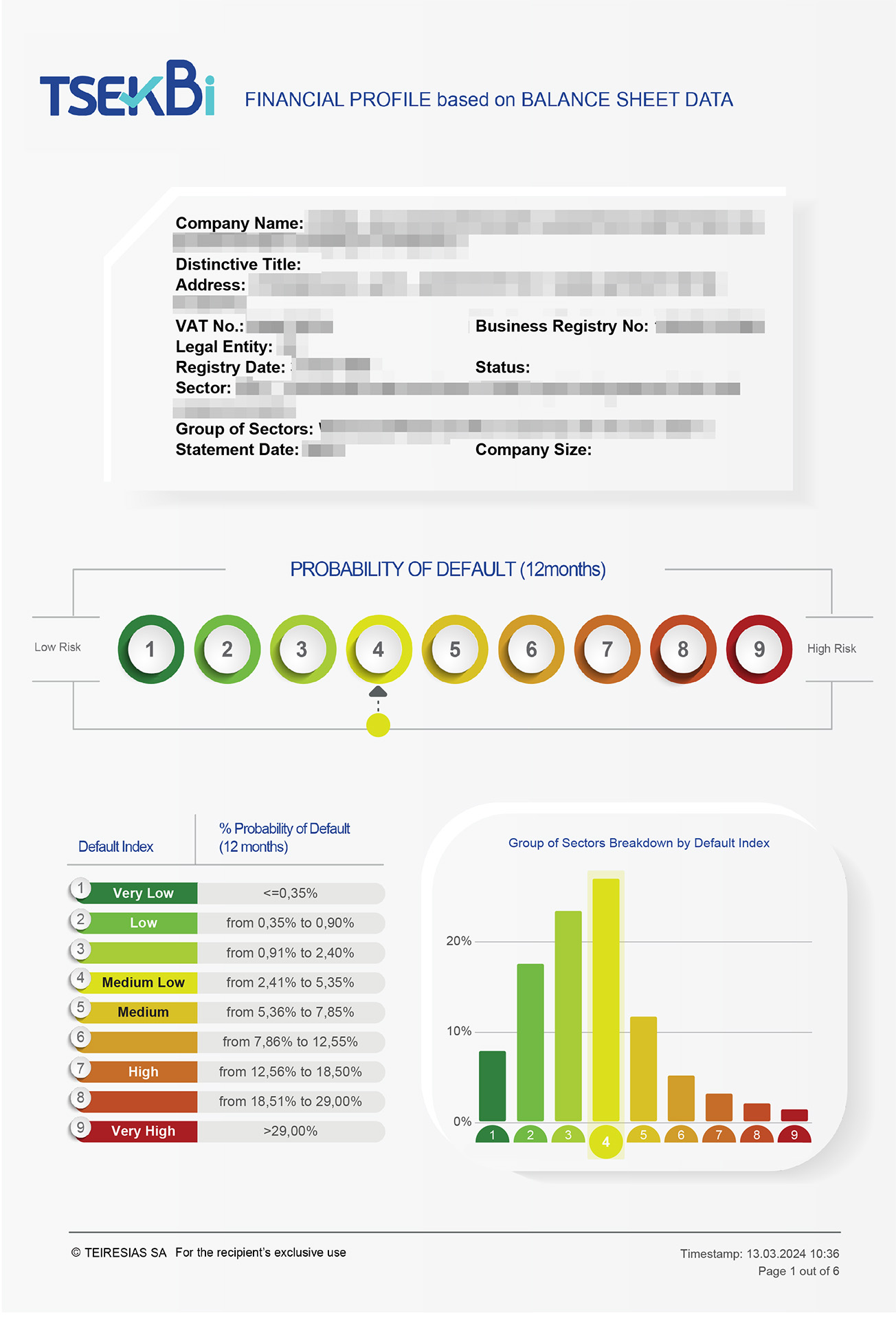

- Information about the company requested (GEMI number, Αctivity Code, size, etc.).

Probability index of the company defaulting on its financial obligations for the next 12 months.

The index is represented on a ranking scale from 1 to 9. As the company's ranking approaches grades 1 to 3, the likelihood of defaulting on its financial obligations in the next 12 months decreases. Conversely, as the company's ranking approaches grades 7 to 9, the likelihood of defaulting increases.

If a company's index falls between 4 and 6, you may utilize financial behavior data in conjunction with the balance sheets and sector indicators provided by the TSΕΚ platform in order to have even more comprehensive information for the assessment of its creditworthiness.- A graph showing the distribution of companies in the specific sector by default index as a percentage, in order to assess the relative position of the company

- Explanatory table of indices and the probability of defaulting on financial obligations for each index.

Data of the most recent financial statements of the company published and digitalized by Tiresias.

TSΕΚ Bi is generated for businesses with a turnover and/or total assets over €10,000 operating in Greece.

Additional benefits for your company include:

- Real-time access to the TSΕΚ Bi report for one or more companies.

- Immediate assessment of the probability of default for the company or companies of interest.

- Combining and verifying the TSΕΚ Bi index with financial behavior and business data from TSΕΚ.

- More effective management of your client portfolio and adjustment of your credit policy.

Businesses TSEK Bi is for:

All businesses, regardless of industry sector or size, engaging in credit transactions.