Instant Credit ID

Maximize instantly the benefit to your customer relationships with the Instant Credit ID service

Any business that offers a product or service on credit, in order to make the right decisions to grow, needs to have valid and reliable data at its disposal to assess the creditworthiness of its customers and reduce the risks arising from commercial transactions. The credit report of a prospective customer is an internationally used tool for checking the creditworthiness of a company's customers.

Tiresias' new Instant Credit ID service for businesses offers you:

Speed - faster assessment of your customers' creditworthiness

Speed - faster assessment of your customers' creditworthiness Ease - comprehensive insight into the customer's credit behavior, instantly

Ease - comprehensive insight into the customer's credit behavior, instantly Reliability - data from the most up-to-date records, from Tiresias

Reliability - data from the most up-to-date records, from Tiresias Transparency - full information about your customers and direct access to their data

Transparency - full information about your customers and direct access to their data Flexibility - API solution that adapts to your needs

Flexibility - API solution that adapts to your needs

| What is the Instant Credit ID service |

Tiresias' new innovative Instant Credit ID service is an API (automatic system connection) application, through which businesses are able to receive instantly, reliably and transparently, comprehensive summary information on the credit and transactional behaviour of their customer, company or individual, in their commercial transactions.

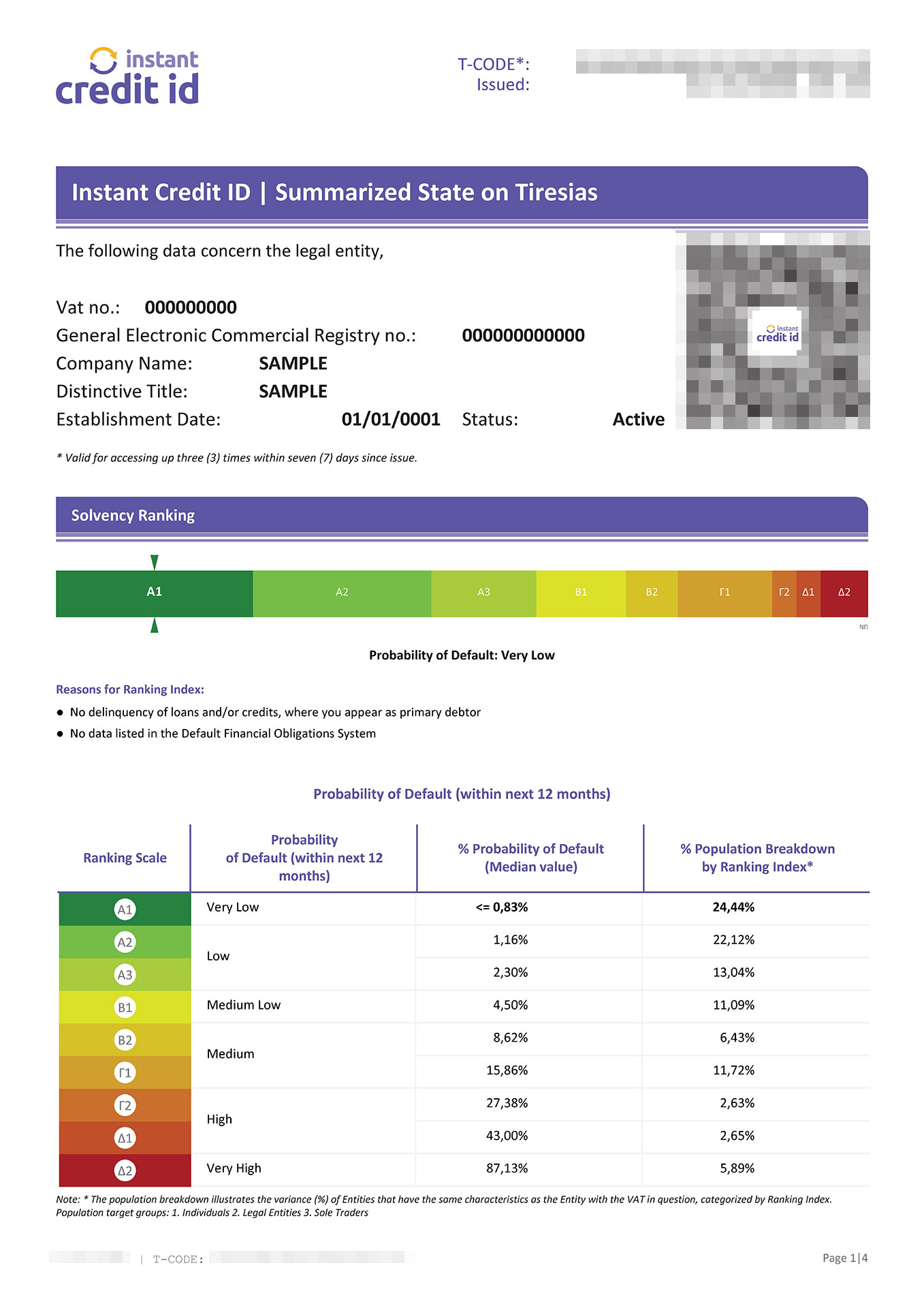

It provides summary financial information on the type and amount of credit and loans and their consistent or non-repayment as well as the solvency ranking of your client. |

| How it works | The above data is sent via API in real time to your business, provided that you have previously obtained your customer's written consent to access their financial data, as held in Tiresias' records. At the same time, a corresponding report is automatically generated in a pdf file and sent to your customer, thus enhancing transparency and data completeness. The data is intended only for your company's own use and only for the person directly transacting with you. |

| What information you get with the service |

With Instant Credit ID you receive:

|

Specifically:

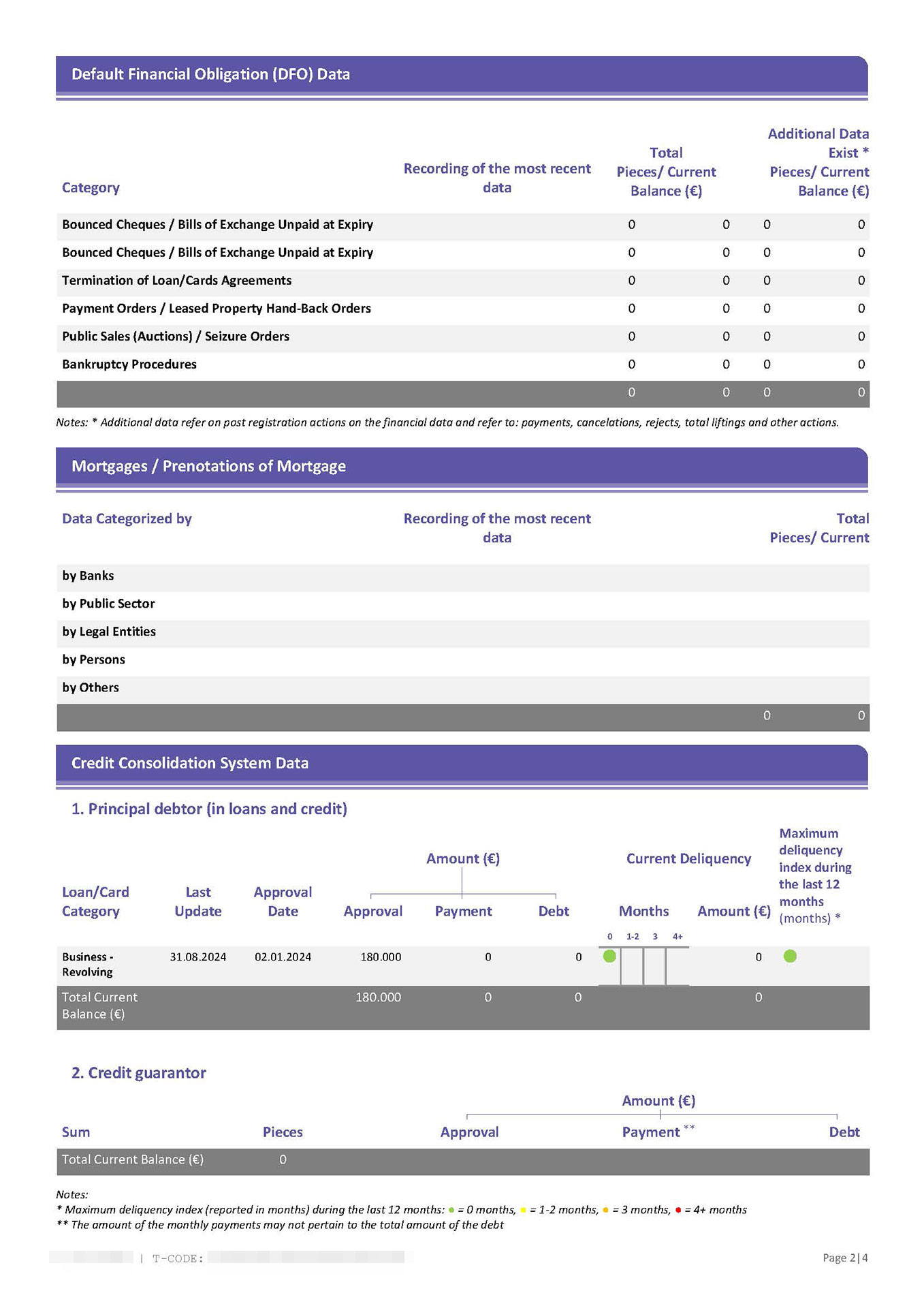

- amount of approval, installment and debt per loan

- total amount outstanding

- participation in loans as guarantor (total of loans, pieces and outstanding amount)

- delay indicator: refers to the consistency of repayment of obligations (months of delay and amount outstanding per loan)

- index of maximum delay in repayment of the loan over the last 12 months

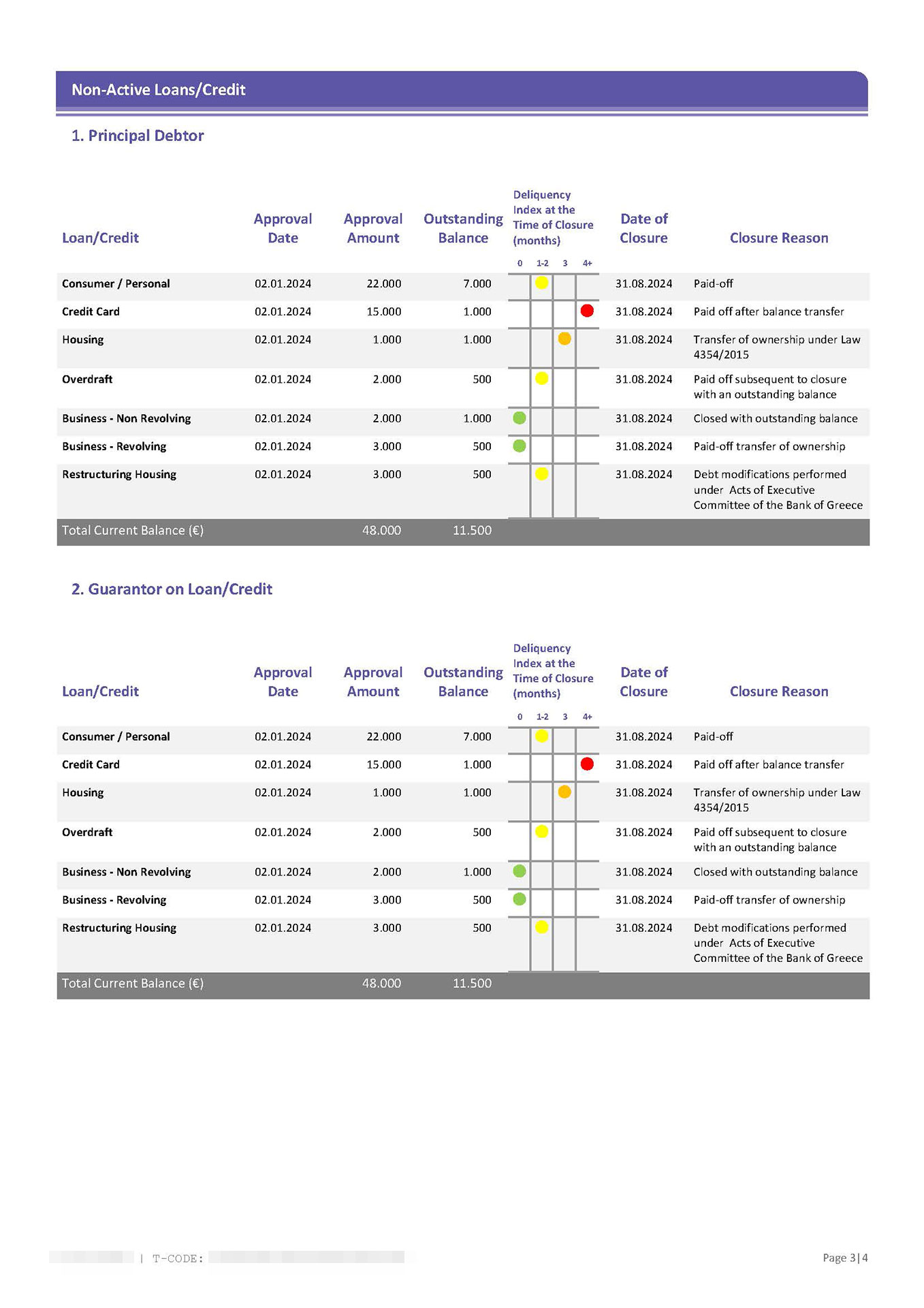

- approval and closure date

- amount of approval and outstanding balance

- delinquency indicator at the time of closure

- closure reason

- pieces, amount owed per data category and total amount owed

- date of the most recent data entry by category

- evolution of financial data by category (repayment, cancellation, annulment, rejection, total waiver, etc.)

The information comes directly from the Tiresias database, the most valid and complete database of financial behavior, which is constantly updated with information from Financial Institutions, Courts, Mortgage Registries, the Land Registry and the General Commercial Registry (GEMI).

| Which businesses can get the service | Businesses that transact directly on credit with their customers and need immediate access to financial information to assess the credit risk in any commercial transaction. |

What is the benefit for your business with Instant Credit ID

Supports the growth of your business and helps increase revenue

Reduces the risk taken in transactions

Facilitates and offers transparency in transactions with your customers

Reduces time needed to manage and assess transactions

With the Instant Credit ID service you can assess for your prospective or existing customer, company or individual:

Therefore, you:

- the consistency of repayment of their loans (loans & cards)

- the probability of default on a new credit

- their reliability and creditworthiness, based on their past behavior in relation to their financial obligations

Therefore, you:

- reduce decision time for credit transactions

- can adjust your credit policy on a per-customer basis

- identify new business opportunities

- improve your customer relationships

- can assess and manage the risk taken

Benefits for your customer

Your customer, company or individual:

- simplifies their transactions with your business

- reduces the time required to search for financial data

- ensures, on a case-by-case basis, more favorable transaction conditions

- has direct access to and control of his/her financial data, which are stored in the Tiresias archives

- is informed in detail about the Instant Credit ID service. See the information document here

| How do you get the service |

The Instant Credit ID service is a flexible API solution that adapts to your business's online systems. You may also receive data through a web application, if this suits better your needs.

Fill out the form below and we will contact you directly to review your needs and how you can benefit from the service. |